Tips for Setting Up or Optimising Your Fund

SMSFs are more popular than ever before with families and individuals seeking more involvement in their retirement savings. According to the latest figures from the ATO, almost 1.2 million Aussies have a self-managed super fund (SMSFs).

While SMSFs offer more control over investments, they also come with increased management requirements, and accountability upon individual members.

So, we’re looking at how to apply SMSF bestpractice principles to ensure you’re compliant, efficient, and aligned withlong-term financial goals.

Whether you're looking to set up your first SMSF orimprove how your existing fund operates, here’s tips on SMSF setup,structure, compliance, and ongoing management in 2025.

Starting an SMSF? 3 Best Practice Foundations to SMSF Establishment:

1. Clearly Define the Purpose and Objectives of the Fund

To remain compliant, every SMSF must exist solely to build retirement savings. SMSF best practice goes beyond compliance, however. Successful funds start with a written investment strategy which is tailored to satisfy the needs and objectives of all members, accounting for:

- The age of individual members and their risk tolerance

- Current balances and contribution plans

- Desired asset mix (e.g. property, shares, cash, etc.)

- Liquidity requirements for future pension payment

2. Choose the Right Structure

Today, SMSFs can have between one and six members, and select to operate under a corporate or individual trustee structure.

SMSF have always been very popular with families –mostly couples until recent updates in 2021 which have allowed for up to six members, paving the way for more multi-generational SMSFs.

When selecting the right structure for your SMSF, best practices includes:

- Weighing the pros and cons of individual versus corporate trustees

- Establishing well-defined roles and responsibilities between members

- Planning for succession, including what happens if a member passes away

3. Engage Professional Support Early

While the SMSF model allows more control, it doesn’t mean you need to manageeverything solo. Best practice managing an SMSF involves engaging anaccountant, SMSF specialist, or administrator early in the setup phase to:

- Ensure the trust deed is correctly drafted

- Register the fund with the ATO

- Set up bank accounts and rollover procedures

- Understand ongoing lodgement and reporting obligations

Here’s an article covering the different services which can be covered by accountants and advisersregarding the setup and ongoing management of your SMSF fund.

Best Practice Management of Your SMSF in 2025:

Once your SMSF is set up, it’s important to keep on top of relevant regulatory updates, either first-hand, or with the support of a financial advisor or SMSF specialist.

It’s also important to weigh up any changes incircumstances for members that has implications for the fund and its trustees,including:

1. Regularly Review Your SMSF Investment Strategy

Markets change, as do member needs over time. Therefore, your approach to your retirement savings must also be regularly reviewed and updated. A best-practice fund:

- Reviews its investment strategy annually (or more frequently than every 12 months, if circumstances change

- Rebalances asset allocations in line with member ages or market trends

- Documents all decisions made by the trustee(s)

2. Stay Compliant and Audit-Ready

This year, the ATO has warned the industry about increased scrutiny on particular areas of SMSF compliance - namely

- Late SMSF Annual Return (SAR) lodgements

- Non-arm’s length income (NALI)

- Overuse of limited recourse borrowing arrangements (LRBAs)

- Objective valuation of SMSF assets

These issues, and any other risks to compliance will typically be discovered during the annual SMSF audit and reported to the ATO. Here’s an article designed to keep trustees on top of the audit process.

Compliance best practices in 2025 includes:

- Keeping digital records organised and accessible

- Working proactively with your auditor before year-end

- Using SMSF admin software or platforms to simplify SMSF activity tracking

3. Prioritise Asset Liquidity and Diversification

Generally speaking, a diversified fund that can meet pension payments and any unexpected costs is far more resilient to market shifts and member needs.

Therefore, when considering liquidity throughout the lifecycle of the fund, trustees should ask these questions:

- If a member needs to draw down on their pension today, could the SMSF fund this?

- Are we over-concentrated in a single asset or asset class?

- Do we need to review property valuations or insurance arrangements?

- Can we benefit from contribution splitting or recontribution strategies?

As always, it’s ideal to check in with a licenced financial planner or SMSF accountant when considering options.

4. Plan Ahead for Retirement and Succession

With more SMSFs transitioning into the pension phase, best practice includes:

- Ensuring pension documentation is in place and reviewed regularly

- Updating binding death benefit nominations

- Reviewing tax implications and legacy planning strategies

Staying Ahead of the Curve

In 2025, SMSF trustees are not only expected to be financially prudent but also expected to be more tech-savvy and engaged with changes to super legislation.

Therefore, it’s a good idea for SMSF members to subscribe to ATO updates and check out some of their online educational modules. Lean on licensed professionals who can help with the somewhat complex and burdensome task of keeping up with SMSF legislation and optimal strategies.

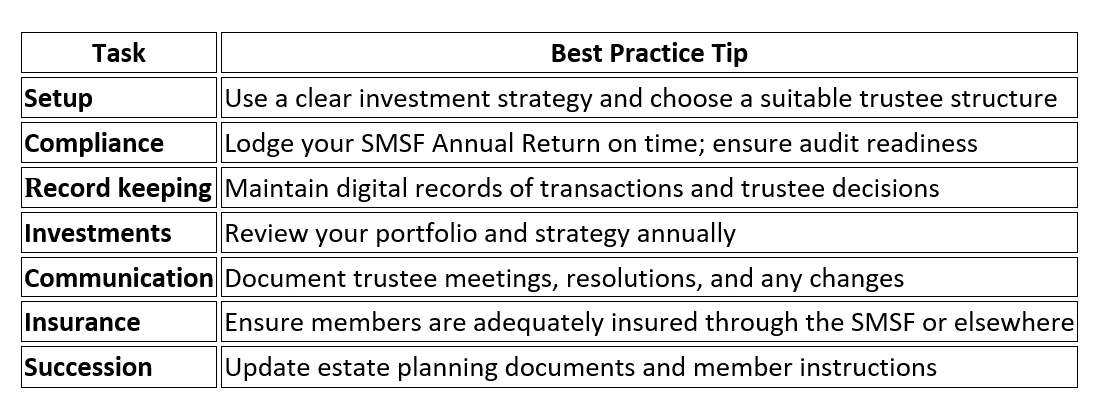

SMSF Best Practice Checklist for 2025

In addition to routine SMSF annual return and audit processes, the following checklist will assist with priority actions according to the lifecycle of your SMSF.

As always, Prime Financials’ SMSF experts are available to provide nuanced advice that factors in all 2025 legislative conditions and changes as they occur throughout each phase of your preparation and commencement of your retirement.