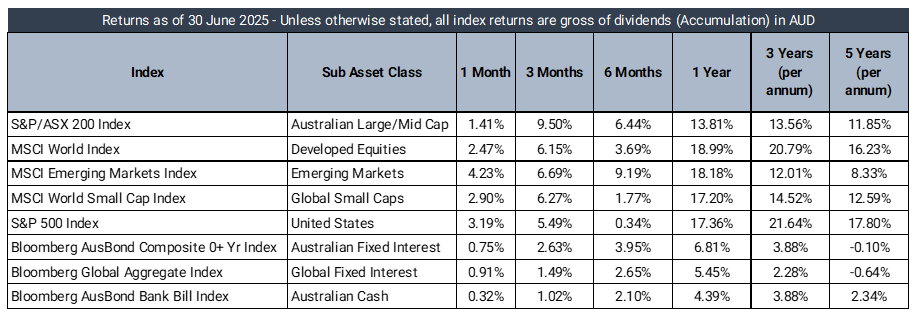

Market Data – June 2025

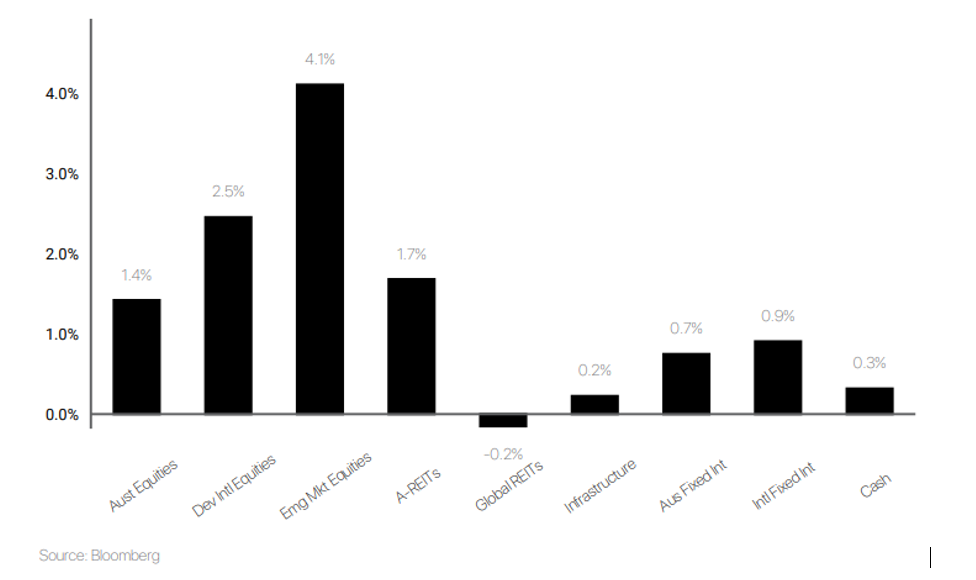

Market Returns - 1 Month to 30 June 2025 (in AUD)

Market Commentary

June 2025 saw financial markets navigate a complex backdrop shaped by trade tensions, softening economic data, and shifting central bank rhetoric. Uncertainty dominated, driven by U.S. tariff developments and geopolitical flare-ups, though most equity markets ended the month higher.

The U.S. dollar hit a two-year low after President Trump doubled steel tariffs, sparking fears of retaliation. Nevertheless, risk assets rallied—emerging markets and U.S. small-caps rose modestly, while the Nasdaq posted strong gains. Bond yields fell, with 10-year Treasuries down 11bps, reflecting growing growth concerns.

U.S. data was mixed. Manufacturing, construction, and services activity softened, while payrolls remained solid and job openings surprised to the upside, hinting at underlying labour market resilience. Consumer confidence dropped sharply, and home prices declined further. Oil prices swung sharply—first surging on U.S. strikes on Iranian nuclear sites, then retreating after de-escalation. Gold briefly hit record highs before stabilising.

Central banks grew more dovish as several Fed officials signalled openness to rate cuts if inflation remained contained. Markets now price in nearly 60bps of cuts by year-end. Japan’s inflation rise put pressure on the BoJ, though weak output tempered hawkish moves. The ECB cut rates amid a ‘goldilocks’ mix of falling inflation and low unemployment, while the OECD cut its 2025 global growth forecast from 3.1% to 2.9%.

In Australia, the ASX 300 rose, led by tech, banks, and consumer discretionary names. RBA minutes showed debate around easing, while weak GDP and CPI data increased expectations of a July cut.

Looking ahead, attention turns to inflation and employment data. Central banks remain data-dependent, with trade uncertainty likely to keep volatility elevated.

Defensive Income

The Prime Defensive portfolio produced a +0.75% return over the month of June relative to a +0.32% target return. The portfolio has delivered a +7.34% return over the past 12 months, +2.96% above the target return.

Credit markets performed well in June in the midst of geopolitical tensions and growing signs of economic weakness. US yields shifted lower across the curve with the 10y closing the month - 17bps lower at 4.23% and the 2y down -18bps at 3.72%. This was driven by a combination of dovish Fed rhetoric and a string of soft macroeconomic data. Notably, first-quarter GDP was revised down to a -0.5% annualised contraction, while consumer confidence remained suppressed, with the University of Michigan Sentiment Index hovering near multi-decade lows. Despite this, US credit indices continued the momentum of the move in May, with the CDX HY 5y -33bps tighter at +318bps.

Domestically, yields were similarly lower across the curve, as a softer-than-expected CPI print further bolstered the likelihood of an already priced in July rate cut. The ACGB 10y yield decreased by -10bps to4.16%, while our 2y was down -7bps to 3.21%. Capturing the risk-off move, local credit spreads moved slightly wider, as our A$ True Corps A-rated 5y index widened +4bps to +115bps, and our A$ B4 T2 FRN 5y index widened +1bp to +172bps.

The top performer for the Portfolio was Pimco Global Bond Fund (+1.37%), contributing +17bps. The income received during the month was bolstered by mark-to-market gains following strong offshore duration performance.

At the beginning of June, we had excess cash on hand, largely stemming from transactions executed in May. These trades left us we from a LIT exposure standpoint to participate in the La Trobe Financial offer which began trading as of the 27th of June. Following this, to maintain cash levels comfortably above our minimum requirement, we have slightly trimmed our exposure to the Artesian Corporate Bond Fund.

Australian Equities

The Prime Australian Equities Growth Portfolio returned 1.8% in June, participating in the broader market strength as investor sentiment improved following moderating inflation data and steady domestic economic indicators.

Gains were relatively broad-based, with contributions from a mix of sectors and market capitalisations. Santos Ltd (16.2%) was a standout performer, supported by firm energy prices and renewed interest in undervalued cyclicals. Metcash Ltd (15.7%) and Collins Foods Ltd (19.7%) also provided notable upside, with both benefiting from resilient consumer trends and improved margin outlooks. Exposure to James Hardie Industries (17.7%) added further to returns amid strength in building materials linked to the U.S. housing market.

However, some headwinds persisted, notably Domino's (-17.8%) and Nanosonics (-8.8%) detracted as sentiment towards higher-growth, discretionary names remained mixed. Select exposures to the health and technology sectors also lagged broader market gains, reflecting cautious investor positioning. Over the twelve-month period, the portfolio’s muted return lagged the benchmark and reflected the challenges faced by active strategies in an environment dominated by narrow market leadership and macro-driven momentum. The sharp outperformance of the major Australian banks and resource giants, fuelled by robust earnings revisions, and strong institutional flows, created a tough benchmark for more diversified portfolios to keep pace with. While individual names like Brambles (66.9%) and Telstra Group (42.7%) within the portfolio delivered strong performance, these gains were not enough to offset broader challenges.

International Equities

The Prime International Growth Portfolio delivered a return of 2.8% in June, responding positively to broad-based equity gains across global markets.

Strong performance in U.S. equities buoyed the portfolio, with the iShares S&P 500 AUD Hedged ETF (4.9%) and Munro Concentrated Global Growth Fund (5.7%) leading monthly contributions. Both benefited from are bound in growth and tech-related sectors, which saw renewed investor enthusiasm amid declining inflation prints and softer central bank rhetoric. Munro’s thematic focus on innovation and quality growth names remained well aligned with prevailing market leadership.

Returns were tempered by a modest pullback in Japanese equities, with iShares MSCI Japan ETF (-0.7%) detracting over the month. The portfolio's emerging markets exposure, Trinetra Emerging Markets Growth Fund (-0.5%), also lagged as sentiment remained cautious despite improved macro data out of Asia.

Over the past 12 months, the portfolio has benefited from strong stock selection and timely manager positioning. The Munro Concentrated Global Growth Fund returned an impressive 28.4%, while the Langdon Global Smaller Companies Fund gained an impressive 27.1%. The Aoris International Fund also delivered a solid 19.7%, with its consistent quality tilt proving resilient through varying market regimes. On the other hand, the GQG Partners Global Equity Fund (-2.5%) was the largest detractor, with its valuation-aware strategy underwhelming amid a sustained growth-led rally.

The information in this article contains general advice and is provided by Primestock Securities Ltd AFSL 239180. That advice has been prepared without taking your personal objectives, financial situation or needs into account. Before acting on this general advice, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should obtain and read the Product Disclosure Statement (PDS) before making any decision to acquire any financial product referred to in this article. Please refer to the FSG (www.primefinancial.com.au/fsg) for contact information and information about remuneration and associations with product issuers. This information should not be relied upon as a substitute for professional advice, and we encourage you to seek specific advice from your professional adviser before making a decision on the matters discussed in this article. Information in this article is current at the date of this article, and we have no obligation to update or revise it as a result of any change in events, circumstances or conditions upon which it is based.