Market Data - September 2025

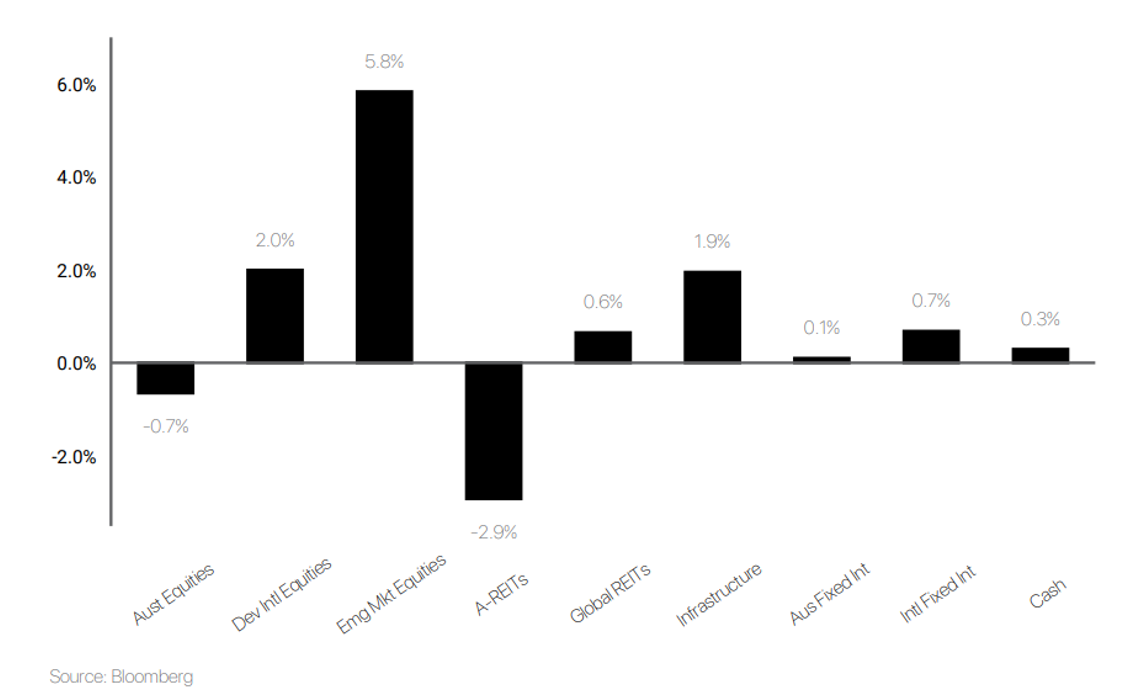

Market Returns - 1 Month to 30 September 2025 (in AUD)

Market Commentary

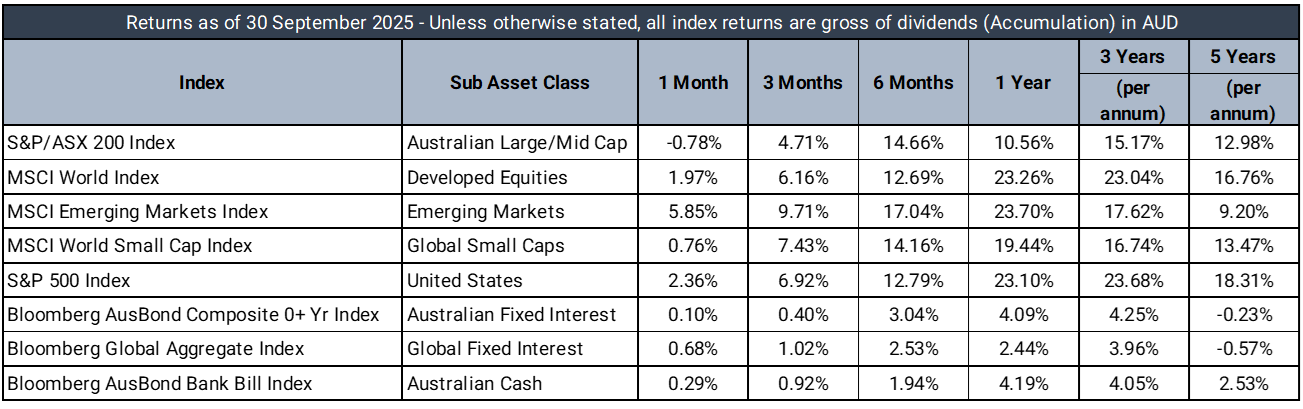

The third quarter of 2025 tested global markets as investors navigated shifting central bank policies, persistent trade uncertainties, and evolving economic signals. Despite considerable volatility, markets demonstrated surprising resilience, with gold emerging as the standout performer, breaking successive records to surpass $3,800/ounce.

Central banks began easing policy as economic uncertainty grew. The Reserve Bank of Australia held rates steady in July, then cut by 0.25% to 3.6% in August as inflation pressures eased. The Bank of England and Reserve Bank of New Zealand also lowered rates during this period. In the U.S., a weak August jobs report showing just 73,000 new positions prompted the Federal Reserve to cut rates by 0.25% in September, though Fed Chair Jerome Powell cautioned that policy was "not on a preset path," cooling hopes for further aggressive moves.

Trade developments continued to inject volatility throughout the quarter. July saw swift resolution of the U.S. Canada digital services tax dispute, but unexpected tariff announcements targeting Japan, South Korea, South Africa, and other nations followed, with rates ranging from 25% to 40%. By September, new tariffs on 68 countries and the European Union reignited supply chain concerns, though Europe's swift removal of tariffs on American goods offered some relief.

Major equity indices reached record highs by the end of September, propelled by strong technology sector performance and enthusiasm for AI. However, the Australian reporting season proved challenging, with unusual earnings misses highlighting stretched valuations. European manufacturing slowed even as the euro climbed to a four-year high against the dollar, while Chinese equities showed quiet resilience and the Japanese Nikkei reached record highs. Australia's dollar climbed over 3% to 66.7 U.S. cents, though the ASX 200 gave back gains as inflation drifted above 3% in September.

Defensive Income

The Prime Defensive portfolio produced a +0.35% return (before platform administration fees) over the month relative to a +0.29% target return. The portfolio has delivered a +6.13% return over the past 12 months, +1.96% above the target return.

US fixed income performed well in September as yields fell whilst spreads remain close to historical tights. At the beginning of the month, weak US employment data, alongside mixed inflation reports bolstered expectations of slower growth and a more accommodative Fed. This triggered the UST 10y to fall to 4.02% intramonth and the UST 2y yield to reach its lowest level in three years at 3.49%. These respectively closed the month at 4.15% and 3.60%, as following the 25bps rate cut to 4.00-4.25% on 18- September, there was conflicting rhetoric from Jerome Powell citing both the dangers of cutting rates too fast or too slow.

Domestically, credit performed but yields increased, with the RBA holding rates at 3.60% and the yield curve bear flattening. The ACGB 10y yield finished the month up +2bp to 4.29%, and our ACGB 2y was +15bps higher to 3.48%. This duration underperformance was largely offset by tightening in local credit spreads. Our A$ B4 T2 FRN 5y index closed the month -6bps tighter at +132bps, sitting materially tighter than the YTD average of +154bps. The A$ B4 Snr FRN 5y index narrowed -4bps to +69bps, and the A$ IG Corporate Hybrid 5y index tightened -6bps to +175bps.

The top performers for the Portfolio Realm High Income Fund (+0.81%), and PIMCO Global Bond Fund (+0.64%) contributing +4bps and +6bps respectively, as spreads continued to grind tighter, and duration performed in US and EU.

During the month, we settled on our ~7.5% allocation to CIMHA. To fund our upcoming allocation to DMNHA, which lists 17 October, we have trimmed our allocations to PIMCO Global Bond Fund and Yarra Higher Income Fund by ~2.5% and ~1.4%, respectively.

Australian Equities

The Prime Australian Equities Portfolio fell -1.46% in September.

In mid-September, management of the portfolio was transferred from InvestSense to Lincoln Indicators (Stock Doctor), following its acquisition by Prime Financial Group.

Stock Doctor applies a disciplined, data-driven investment process built on decades of research and a proven methodology. The approach focuses on identifying financially healthy, high-quality businesses while minimising unnecessary risk.

The core philosophy of maintaining a diversified equities portfolio remained central, with investments directed toward companies with strong balance sheets, resilient cash flows, and sustainable earnings. This approach sought to balance growth potential with prudent risk management, helping the portfolio withstand market volatility while capturing long-term value creation.

With this in mind, the Australian Equities Growth Portfolio SMA was rebalanced, resulting in a slight increase in the number of securities (enhancing diversification) and the addition of a core allocation to ETFs providing exposure to the ASX200. Movements within the underlying portfolio took place around the 12th of September.

International Equities

The Prime International Growth Portfolio returned 1.4% in September 2025, navigating a month where markets consolidated recent gains amid moderating inflation data and evolving central bank signals. While quality growth exposures delivered solid contributions, style divergences within equities created headwinds that tempered results.

September saw continued strength from the Munro Concentrated Global Growth Fund (3.1%) and Munro Global Growth Small & Mid Cap (3.3%), benefiting from renewed enthusiasm for secular growth stories. The iShares S&P 500 AUD Hedged ETF (2.5%) contributed meaningfully as US markets digested prospects for rate stability, while the Plato Global Alpha Fund (3.8%) delivered through its market-neu approach. However, smaller capitalisation strategies faced significant pressure. The Langdon Global Smaller Companies Fund declined 2.9%, representing the portfolio's largest detractor as investors rotated toward larger, more liquid names. The Aoris International Fund (negative 2.4%) and GQG Partners Global Equity (negative 1.0%) also weighed on returns.

Over the twelve months to September 2025, the portfolio generated a 22.5% return, with exceptional performance from the Munro Concentrated Global Growth Fund (36.6%) and iShares S&P 500 AUD Hedged position (23.1%) accounting for the majority of gains. Japanese equities contributed strongly through the iShares MSCI Japan ETF (20.1%), while European exposure (18.2%) and emerging markets through Trinetra (16.8%) provided valuable diversification.

The primary headwind over the full year came from GQG Partners Global Equity, which declined 1.1% as its contrarian positioning against expensive technology stocks proved premature in a market rewarding growth and momentum. The portfolio's diversified approach across styles and regions delivered strong results through a period marked by the Trump election aftermath, trade policy uncertainty, and significant sector rotations between value and growth factors.

The information in this article contains general advice and is provided by Primestock Securities Ltd AFSL 239180. That advice has been prepared without taking your personal objectives, financial situation or needs into account. Before acting on this general advice, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should obtain and read the Product Disclosure Statement (PDS) before making any decision to acquire any financial product referred to in this article. Please refer to the FSG (www.primefinancial.com.au/fsg) for contact information and information about remuneration and associations with product issuers. This information should not be relied upon as a substitute for professional advice, and we encourage you to seek specific advice from your professional adviser before making a decision on the matters discussed in this article. Information in this article is current at the date of this article, and we have no obligation to update or revise it as a result of any change in events, circumstances or conditions upon which it is based.