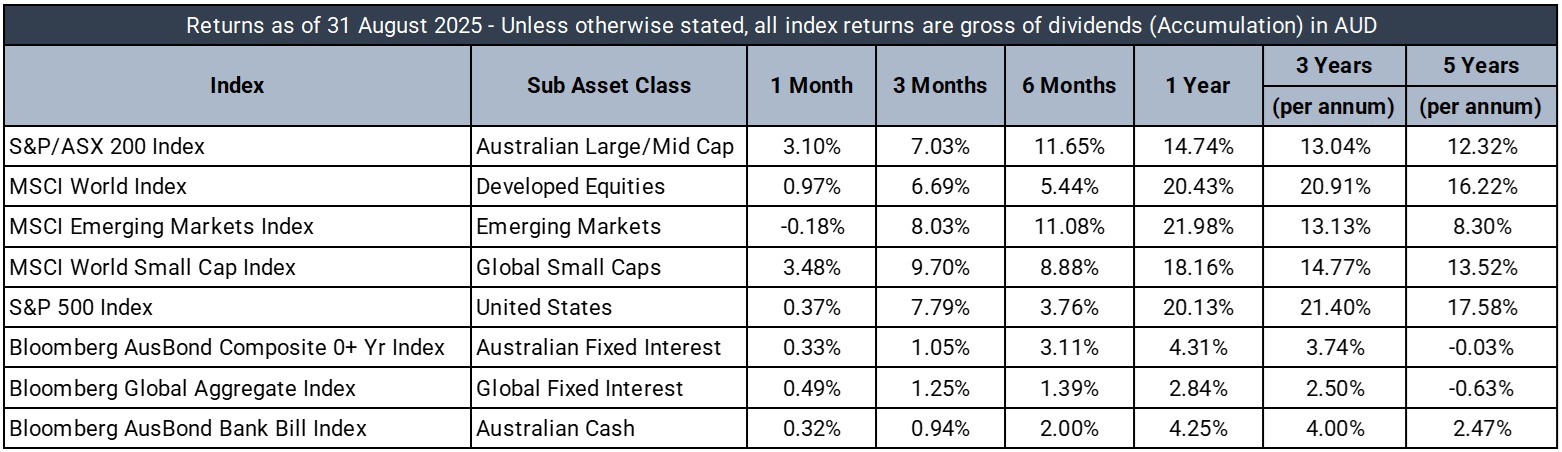

Market Data - August 2025

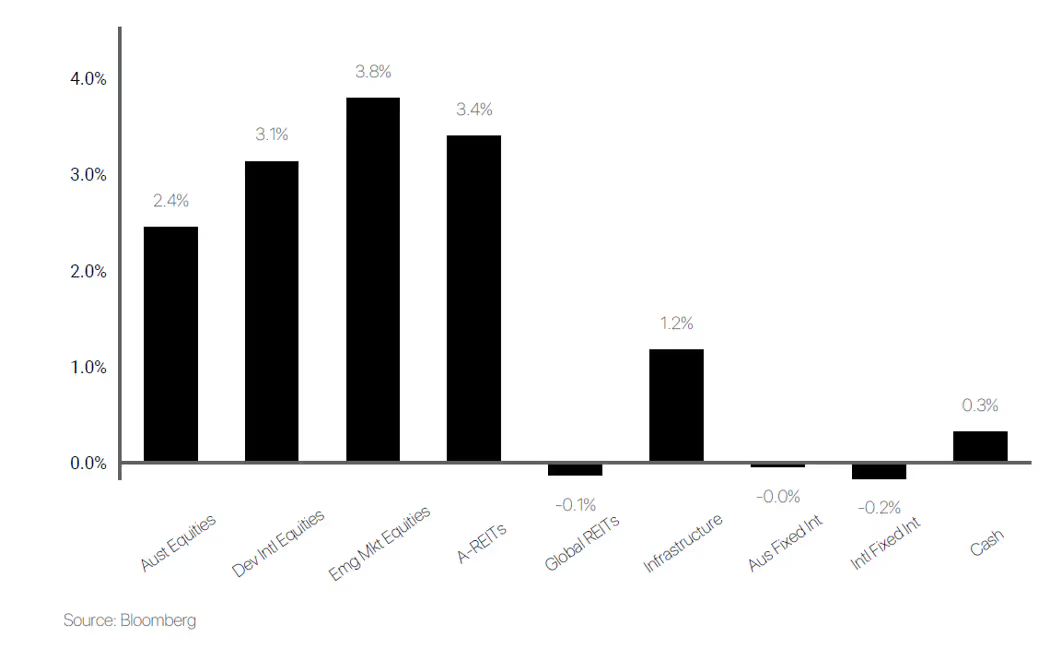

Market Returns - 1 Month to 31 August 2025 (in AUD)

Market Commentary

August 2025 was dominated by fears of a global economic slowdown, with investor sentiment swinging between caution and relief as markets digested weak economic signals alongside surprisingly resilient equity performance. Concerns over labour market softness in the U.S., renewed trade tensions and shifting central bank expectations created a volatile backdrop, yet major indices in the U.S. and Europe managed to hold firm, supported by robust technology earnings and optimism that tariff deals might at least reduce uncertainty. This uneasy balance between deteriorating fundamentals and market resilience was the central theme of the month.

Globally, the release of U.S. non-farm payrolls data confirmed the fragility of the recovery, with only 73,000 jobs added and unemployment edging up to 4.2%. The disappointment sent two-year Treasury yields down as investors priced in near-term rate cuts, while the dollar fell about 2.0%. Europe fared little better, with industrial production contracting, though the UK surprised positively with 0.3% GDP growth, prompting the Bank of England to deliver a dovish 25 basis point cut. In Asia, China’s economy continued to struggle, with retail sales declining for a second month and property prices falling further. Commodities added to the uneasy mood, with Brent crude slipping below $63.7 per barrel after OPEC+ signalled increased supply.

In Australia, the tone was mixed. June retail sales rose 1.2% and easing inflation allowed the Reserve Bank of Australia to trim the cash rate to 3.6%. A strong trade surplus, underpinned by surging gold exports, also offered support. However, the August reporting season proved more sobering and highly volatile. With a spat of earnings disappointments, particularly from big names such as CSL, weighing on sentiment.

Looking ahead, investors continue to navigate a landscape shaped by potential central bank support and lingering concerns about the global growth outlook. While market resilience in August provided a degree of reassurance, ongoing trade tensions and mixed economic signals suggest that portfolios may remain sensitive to shifts in sentiment.

Defensive Income

The Prime Defensive portfolio produced a +0.48% return (before platform administration fees) over the month relative to a +0.32% target return. The portfolio has delivered a +6.63% return over the past 12 months, +2.38% above the target return.

Credit markets performed strongly in August as yields fell, and spreads tightened. Early in the month, revisions to US non-farm payrolls revealed the weakest 3-months job growth (outside the pandemic) since 2011. The US yield curve bull steeped as the 2y yield closed -34bps tighter at 3.62%, and the 10-year fell -14bps to 4.23%. US credit spreads continued to grind tighter, with some indices hitting historic spread tights intra-month. This underscores a growing divergence between what long-end Treasury yields suggest about the broader economy and what credit and equity markets are pricing. The 5y IG and HY CDX indices were both flat MoM at +51bps and +323bps, respectively.

Domestically, the RBA cut rates in line with expectations in August, and the yield curve twist steepened. The ACGB 10y yield finished the month up +1bp to 4.27%, and our 2y was down -7bps to 3.33%. Local credit spreads also largely tightened, supported by continued light supply as the reporting season blackout period approaches completion. Our A$ B4 T2 FRN 5y index closed the month +2bps wider at +139bps, although is sitting materially tighter than the YTD average of +156bps following significant tightening in July. The A$ B4 Snr FRN 5y index narrowed -3bps to +73bps, and the A$ IG Corporate Hybrid 5y index tightened - 12bps to +181bps.

The top performers for the Portfolio were PIMCO Global Bond Fund (+0.92%), and Yarra Higher Income Fund (+0.74%) contributing +11bps and +8bps respectively, the former supported by mark-to-market gains amid duration outperformance.

During the month we continued to trim down our exposure to risk by reducing our State Street Floating Rate Fund allocation (-3.5%). This left our cash levels elevated at ~9.5% as we await the settlement of CIMHA for ~7.5% of the portfolio.

Australian Equities

The Prime Australian Equities Portfolio fell -0.39% in August. Pilbara Minerals (52.6%) was the standout contributor, rebounding strongly on improved lithium sentiment and stabilising spodumene prices. Newmont (15.6%) also advanced, benefiting from a sustained rally in gold prices amid continued global macro uncertainty. Origin Energy (10.7%) gained on firmer energy prices and supportive sector conditions, while Nanosonics (10.6%) rose following renewed optimism around its global distribution partnerships. BHP (10.0%) also added positively as iron ore prices remained resilient.

On the other hand, a number of large-cap names weighed on performance. James Hardie (-24.5%) declined sharply following weaker-than-expected earnings commentary and ongoing U.S. housing sector pressures. CSL (-21.4%) also detracted significantly as the market reacted to cautious updates on margins in its plasma and vaccines divisions. Reece (-17.9%) fell on further signs of softness in housing-related activity, while Domino’s Pizza (-17.5%) pulled back as input cost concerns resurfaced. Wisetech (-14.7%) also declined after investors took profits from its previously strong run.

Overall, August highlighted the divergence across sectors, with resources and energy names delivering strong support, while healthcare, consumer, and housing-exposed names dragged on returns. Stock selection again proved critical, with a handful of materially positive contributors helping to offset notable weakness among several large-cap detractors.

International Equities

The Prime International Growth Portfolio returned 0.9% in August, participating in positive equity markets, although results across managers varied.

Japanese equities were a key contributor, with the iShares MSCI Japan ETF (4.5%) advancing as earnings momentum improved and supportive policy settings underpinned sentiment. The Trinetra Emerging Markets Growth Fund (3.8%) also added meaningfully, alongside the Pzena Global Focused Value Fund (3.6%) which benefited from attractively priced opportunities in global value stocks. The iShares S&P 500 AUD Hedged ETF (1.1%) provided further stability, broadly in line with U.S. market strength.

Not all strategies participated, with high-conviction growth holdings consolidating after strong prior gains. The Munro Concentrated Global Growth Fund (-1.9%) was the largest detractor, while smaller company exposure through the Langdon Global Smaller Companies Fund (-1.7%) and the Aoris International Fund (-2.2%) also weighed on results as quality-oriented positions lagged amid cyclical and growth leadership.

Over the twelve months to August, the portfolio returned 21.2%, reflecting strong contributions from its core growth allocations. The Munro Concentrated Global Growth Fund (33.8%) was the most significant driver, supported by ongoing momentum in technology and innovation. The iShares S&P 500 AUD Hedged ETF (16.1%) also contributed positively, while the Pzena Global Focused Value Fund (18.7%) performed well in a supportive environment for disciplined value investing. These gains were partly offset by weaker results from the GQG Partners Global Equity Fund (-2.9%) and relative underperformance from Japanese equities, where local markets rose 16.1% but portfolio positioning limited participation.

The information in this article contains general advice and is provided by Primestock Securities Ltd AFSL 239180. That advice has been prepared without taking your personal objectives, financial situation or needs into account. Before acting on this general advice, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should obtain and read the Product Disclosure Statement (PDS) before making any decision to acquire any financial product referred to in this article. Please refer to the FSG (www.primefinancial.com.au/fsg) for contact information and information about remuneration and associations with product issuers. This information should not be relied upon as a substitute for professional advice, and we encourage you to seek specific advice from your professional adviser before making a decision on the matters discussed in this article. Information in this article is current at the date of this article, and we have no obligation to update or revise it as a result of any change in events, circumstances or conditions upon which it is based.