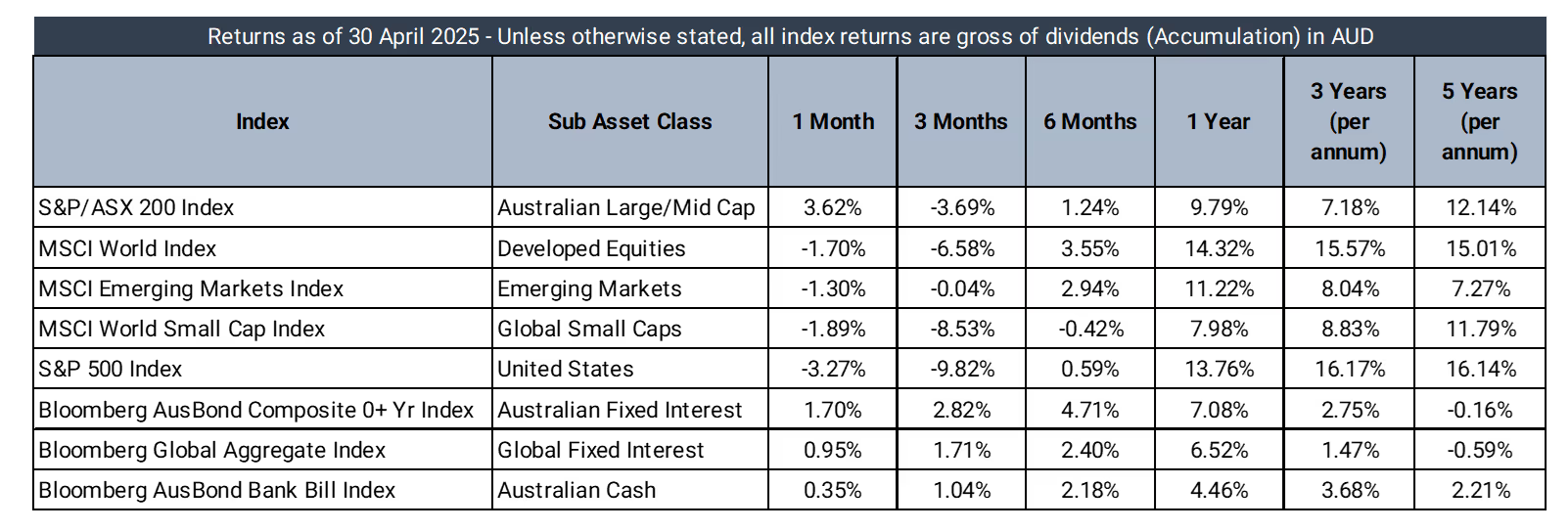

Market Data – April 2025

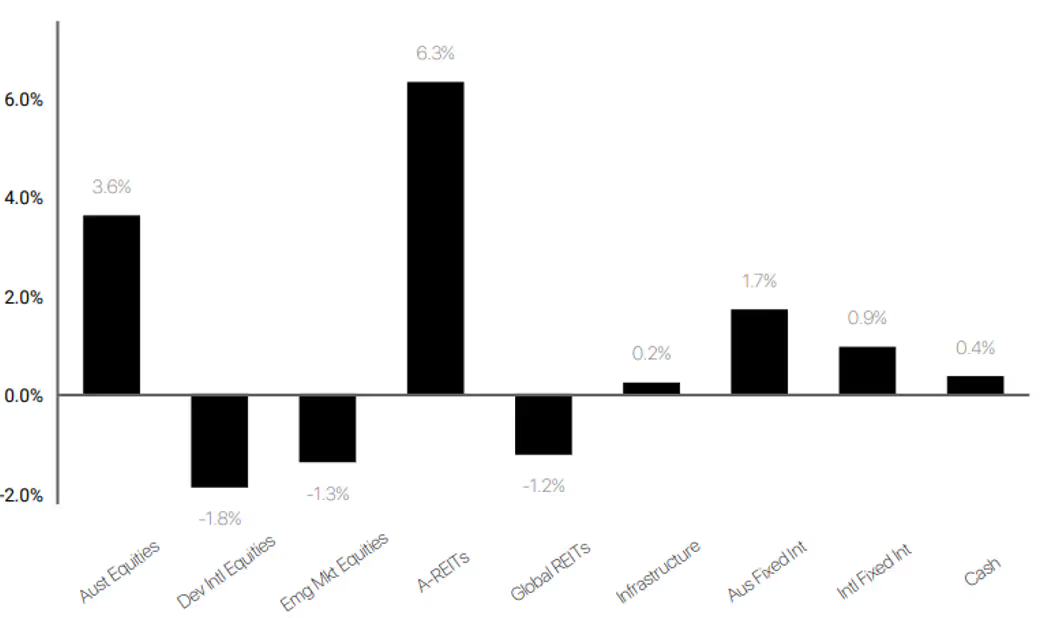

Market Returns - 1 Month to 30 April 2025 (in AUD)

Market Commentary

April 2025 was marked by sharp volatility as markets reacted to shifting trade dynamics, geopolitical uncertainty, and evolving economic signals. The month opened with significant declines following Liberation Day—the U.S. administration’s symbolic declaration of tariff enforcement—which jolted global equities and pushed risk sentiment sharply lower. The sell-off was broad-based, hitting risk assets across the board and sparking a surge in safe-haven demand. While markets recovered later in the month, investor confidence remained fragile amid ongoing uncertainty.

In Australia, equity markets were initially swept up in the global sell-off but showed relative resilience by month-end. The ASX clawed back early losses as easing domestic inflation data and rising expectations for further RBA rate cuts firmed. Domestic bond yields tracked global trends—rising early in the month before easing as macro uncertainty deepened and CPI moderated.

Internationally, U.S. markets endured a turbulent start. Liberation Day triggered fears of a broader global trade wars and potential political interference in the Federal Reserve, as the S&P 500 fell over 12% the week following the Liberation Day announcements. While earnings season offered some relief—over 70% of companies beat forecasts—forward guidance remained cautious. European and UK markets experienced similar swings, recovering somewhat as trade rhetoric softened and expectations of policy support grew.

Bond yields were volatile throughout April. U.S. 10-year Treasuries briefly spiked above 4.4% before retreating throughout the month. Australian yields mirrored the move but ended the month slightly lower. Gold surged to a new all-time high above US$3,480/oz as investors sought safety, while oil prices fell on concerns about slowing global growth.

Looking ahead, markets remain delicately balanced. While earnings have supported valuations, the interplay between hard economic data, central bank policy, and geopolitical noise will likely continue to test investor sentiment.

Australian Equities

The Prime Australian Equities Growth Portfolio advanced 0.7% in April 2025, underperforming the broader S&P/ASX 200 Index. This underperformance largely reflects significant market bifurcation, with Commonwealth Bank of Australia contributing nearly one-third of the index's performance as it surged 10%. The portfolio's deliberate structural underweight to CBA and other expensive defensive stocks like Wesfarmers, which advanced as investors sought perceived safe havens amid global trade uncertainty, proved costly in the short term.

Energy stocks faced substantial headwinds with Santos declining as energy commodity prices softened and investor sentiment shifted dramatically toward defensive sectors. Despite this near-term pressure, Santos remains well-positioned as it approaches the end of its major capital expenditure phase, with significant production increases expected from key projects coming online through 2025-2026.

On the positive side, Woolworths provided stability as investors favored defensive consumer staples amid market uncertainty. Newmont Corporation benefited from the continued strength in gold prices, offering valuable portfolio protection during volatile market conditions.

While recent performance has been challenging, we maintain a strong conviction in our positioning that emphasises long-term value over short-term market movements. The portfolio contains substantial upside potential across numerous holdings that offer more compelling risk-reward profiles than expensive market darlings currently benefiting from defensive positioning. This approach may create periods of short-term underperformance but has historically delivered superior long-term results as fundamentals ultimately drive returns

Defensive Income

April was a turbulent month for global fixed income, as Trump’s unpredictability continues to drive volatility across markets. This was most obvious in the week that followed ‘Liberation Day’, as the President introduced, paused, and increased varying tariffs, which triggered substantial market undulations. The US 10y yield closed the month down 5bps at 4.16%, falling from the intra-month high of 4.49%. High yield widened considerably, up 32bps to 408bps on the CDX HY 5y spread, which followed a 67bps rise in the month prior.

The Australian bond market saw a material shift down in the yield curve, particularly at the shorter end. The domestic ACGB 10y yield fell 21bps to 4.17%, and our 2y yield fell 41bps to 3.27%. Domestic Tier 2 credit spreads widened, as the Tier 2 5-year Major Bank FRN increased to +190bps from February’s low of +145bps. Lifting the subordinated to senior ratio to ~2.0x from its ~1.7x tights, however there is still significant headroom from the long-term average of ~2.6x (noting the one-notch uplift in subordinated Tier 2 credit ratings since April 2024).

Prime delivered a return of +0.39% in April, which once again was a relatively strong result given market conditions. This performance contributed to an impressive 1y and 2y return of +6.95% and +6.45% p.a., outperforming the Bank Bill Index by +2.50% and +2.11%, respectively. Positively, this has been achieved with no negative months recorded since May 2023 (which was a modest negative 3bps).

This excellent performance has been achieved while maintaining consistently low exposure to interest risk (~1.5y duration) and high credit quality (A- portfolio average credit rating). The top performers for the Portfolio were Pendal Government Bond Fund (+1.72%) and MA Priority Income Fund (+0.67%), contributing weighted returns of +17bps and +8bps, respectively. SUBD was the largest detractor (-4bps), driven by a fall in capital price.

During the month, we sold out of our position in SUBD, reducing the portfolios allocation to Tier 2, as credit spreads continued to widen from the historic tights seen in February. We have also reduced our exposure to MA1 (2.49% of the portfolio) and DN1 (2.46% of the portfolio). Some of the excess cash generated from this was quickly re-deployed into purchasing additional units of Pendal Government Bond Fund which delivered strong returns on the back of duration performance.

International Equities

The Prime International Growth Portfolio delivered a positive return of 0.4% in April, outperforming its benchmark which declined 1.7%. This resilience came as markets recovered from early-month volatility triggered by trade policy announcements.

Munro Concentrated Global Growth Fund emerged as the top performer, navigating market turbulence by playing defensively during the initial decline while capturing the subsequent rebound. The portfolio's Japanese ETF exposure, Langdon Global Small Companies, and emerging markets manager Trinetra all delivered strong returns, demonstrating how regional and market-cap diversification provided stability during market uncertainty.

The decision to increase currency hedging for US exposures proved beneficial, with hedged positions outperforming as the dollar strengthened. Meanwhile, value-oriented managers created some headwinds, with Pzena Global Focused Value Fund experiencing a larger decline than expected during market turbulence and GQG Global Equity underperforming.

Over the past twelve months, albeit the recent volatility year-to-date, returns continue to be dominated by a narrow set of US large-cap technology stocks driving significant benchmark performance. The portfolio's more diversified approach across regions and investment styles has meant it hasn't fully captured the concentrated gains in US markets. However, the recent market volatility highlights the importance of diversification, which positions the portfolio for more sustainable long-term returns as market leadership potentially broadens beyond a handful of US technology companies.

Contact

The information in this article contains general advice and is provided by Primestock Securities Ltd AFSL 239180. That advice has been prepared without taking your personal objectives, financial situation or needs into account. Before acting on this general advice, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should obtain and read the Product Disclosure Statement (PDS) before making any decision to acquire any financial product referred to in this article. Please refer to the FSG (www.primefinancial.com.au/fsg) for contact information and information about remuneration and associations with product issuers. This information should not be relied upon as a substitute for professional advice, and we encourage you to seek specific advice from your professional adviser before making a decision on the matters discussed in this article. Information in this article is current at the date of this article, and we have no obligation to update or revise it as a result of any change in events, circumstances or conditions upon which it is based.